Outsourcing in banking: Analysing the risks and benefits

Outsourcing in banking can streamline products and services, empower overworked and under-worked resources, cut costs and add value to their customers.

Under the regulatory framework, banks strive to meet the challenges of capital, financial reporting, and corporate governance requirements. A lot of financial institutions stopped focussing on global capital markets in regard to commercial and retail banking to focus on their ‘core’ activities. Cost optimization is one focus during our banking services to simplify these global operating models.

Simply put, as capital requirements are impacting the pricing of financial products, banks need to lower their operating costs to remain competitive.

Outsourcing to stay in the game

Banks usually have now adopted a paradigm shift in the way they operate by restricting their financial processes. A lot of innovative ideas have evolved over time to manage costs and strategize business objectives for enhanced operational procedures.

Outsourcing in the financial services isn’t new, as banks have been at the forefront of the trend since outsourcing and offshoring started to become the norm in the service sector. Over the last few years, however, outsourcing banking operations has gathered momentum and the nature of the outsourced tasks has evolved.

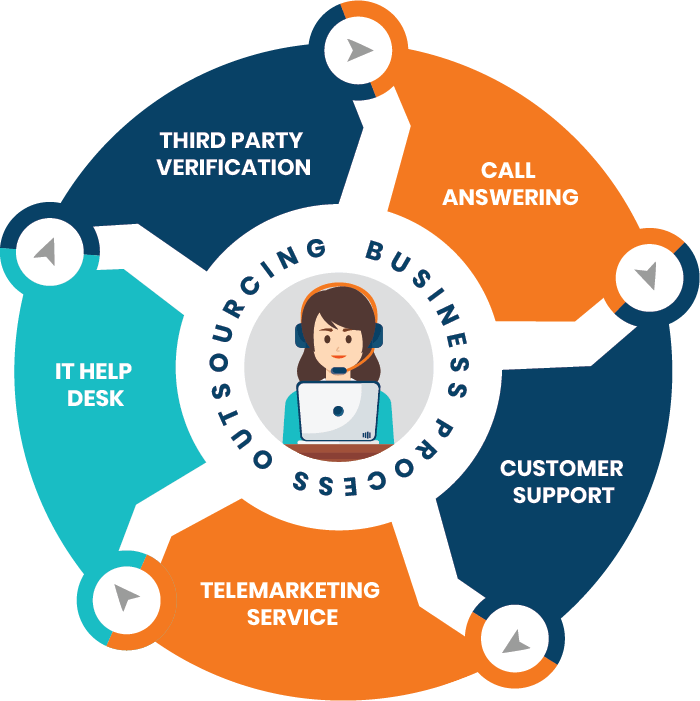

Up until recently, IT processes and client relationship management especially in retail banking, accounted for the majority of large-scale outsourcing, whereas we see an increasing number of banks starting to use managed services for critical processes and support activities. The types of functions now being outsourced range from compliance processing tasks to critical day-to-day business activities.

As per the World Retail Banking Report, close to 77% of retail banks outsource at least one part of their business operations.

While there isn’t an easy solution for every challenge in community banking, outsourcing banking operations can make a swift and positive impact on your bank’s bottom line while freeing up your internal resources to focus on your core competencies.

Improving customer experience in Banking & FinTech

Many financial institutions already outsource core administrative functions like payroll, regulatory compliance, and digital banking services.

What are the benefits of outsourcing in banking?

Eliminate the cost of hiring full-time processors

Banks that resort to managing their loan processing team can find this strategy costly and time-consuming. These full-time loan processors not only require high salaries because of their expertise, but they also need other benefits for workers, related equipment, and so forth. All of these translate to more expenses for the bank or the client firm.

However, outsourcing in banking sector can significantly decrease their outlay. They will benefit from the service of contract loan processors who are usually self-motivated and are focused on closing mortgage loans, all for the benefit of the bank or their client company.

Involve trained processors with accumulative knowledge

Outsourcing loan processors involve skilled and experienced staff. Financial institutions are auspiciously given access to their accumulative expertise.

As client firms, loan process outsourcing receivers get the support of highly qualified professionals. This outsourced personnel helps them originate and fund more housing loans while at the same time facilitating security and stability for their enterprise.

Loans are closed faster and with increased efficiency

Outsourcing back-office loan processors is one of the strategies that an increasing number of mortgage firms and banking institutions have implemented in recent years. This measure has helped them in offsetting any harmful impact of market challenges to their profitability.

The streamlined operations of outsourcing firms make their clients’ loan-processing businesses more efficient and accurate. Thus, loans are closed quickly and on time. Prompt customer payments are achieved, earning the client a solid reputation and a greater competitive advantage.

More time to focus on your core competency

Outsourcing in banking involves the highly skilled team of the service provider adeptly managing excess tasks. This gives relief to lenders like banks because they are delegating excessive work to another company.

Outsourcing firms help maximize their client firm’s growth and profitability by effectively handling a high volume of time-consuming work. Among them are tax monitoring, origination processing, mortgage servicing and sub-servicing, and loan processing.

Accounting, post-closing, underwriting, examination, and title orders are no longer a concern for client firms, too. They can, therefore, have more time to set their priorities more clearly. For instance, they can concentrate more on giving customers better banking experiences, creating new product strategies, and managing compliance risk.

Leverage big data analytics and modeling

Outsourcing enables companies to gain access to big data specialists. Outsourcing analysts facilitate the employment of the correct tools for their clients. Big data pertains to vast sets of customer information used for computational analysis.

They reveal human interactions and behavioral trends, patterns, and associations. Some of today’s biggest and most successful businesses in the world like Capital One, Starbucks, Walmart, and T-Mobile depend on big data analytics. Outsourced specialists deliver the correct type of results based on their clients’ targets, expectations, and budgets.

Therefore, client firms can leverage big data analytics to their optimum benefit.

Accelerate customer satisfaction

Outsourcing in banking helped brokers, and lenders to adapt to the new generation of home buyers and their unique and diverse demands. They concentrate on making the client firms content. They strive to keep an enduring relationship with them, too. Financial institutions are, thus, able to receive excellent customer ratings and consequently increase customer leads or referrals.

A comprehensive guide to financial services outsourcing

What are the risks for banks?

Well-thought-out outsourcing in banking strategy combined with carefully carried out due diligence can set a bank apart from its competitors. That is when everything goes well. But what happens when a vendor doesn’t hold to his end of the bargain or, more likely, makes an unintentional mistake? What then, are the risks for banks?

Companies often focus on making sure vendors deliver, but they sometimes forget about the ancillary, and operational risks of outsourcing. These risks can be very large and significantly impact capital requirements.

There have been multiple instances in recent years where consumer banks had to face serious reputational and financial debacles due to a third party’s error.

Years ago a retail bank left millions of customers unable to withdraw funds or view their balances due to a computer failure, which occurred as one of the bank’s IT vendors was performing a software update.

The failure resulted in the paralysis of critical banking systems –a costly error. Another one had to compensate thousands of customers whose personal information had been stolen and sold illegally. The data had been stored by a vendor on a USB stick which was subsequently lost.

It is important to understand that by importing efficiently, companies are also importing risks.

Scandals have also been frequent in the investment world where rogue traders have lost billions before computer control systems, managed by third-party vendors, detected unauthorized trading patterns.

In a specific instance, a bank lost over a billion dollars because data incriminating one of its traders, collected by a third party, never made it to its compliance team. It had been deleted by error as part of a system upgrade – performed by a vendor.

By increasing their business’ efficiency through outsourcing, these financial organizations have imported significant operational risks into their organization, which resulted in serious financial losses and reputational damage.

Overcoming risks and moving toward outsourcing

More than a decade out from the Great Recession, community banks may have regained their financial footing, but they still face challenges, from a competitive credit and deposit market to demographic changes, rapid advances in technology, regulatory and compliance burdens, cybersecurity and fraud threats, and the pressure to control expenses in a low-rate environment.

Despite these issues, small and regional banks still play an essential role in the communities they serve. Community banks offer leadership on local economic development and charitable donations. They know their customers and prioritize high-touch relationship banking. And local banks are often the lifeblood of the small business community, making loans that bigger banks wouldn’t and advising new entrepreneurs.

For a bank or any financial institution, following a carefully developed and detailed outsourcing methodology is paramount to significantly lower its operational risks.

A handbook to select the perfect outsourcing partner for your business

They should have a clear due diligence approval process for potential companies they outsource to and outsourcing policies to ensure that both parties understand what is expected and how business should be conducted.

In addition, methods should be put in place to monitor those risks related to outsourcing in any particular operational function and controls must be set up to address crisis prevention and contingency planning, potential customer issues, and upcoming changes to both parties’ processes.

Compliance and Operational Risk teams should carry out regular reviews to verify that their suppliers are compliant. Given the potential for extreme loss events, it is also critical to plan ahead and have a capital-efficient solution to mitigate these risks – naturally imported when a company decides to outsource some of its activities.

Risk managers should talk to their brokers about operational risk insurance as risk transfer is a pertinent solution to address such large risks. During the process of banking process outsourcing, banks should be looking for a cover managed by a carrier with sufficient strength and capacity.

While outsourcing provides financial institutions with competitive benefits in today’s challenging business and regulatory environment, it is important to understand that by importing efficiency, companies are also importing risks, which should be addressed by implementing an effective compliance and risk management strategy and the use of tailored operational risk insurance.